Location in Courthouse

We are located on the ground floor of the courthouse in room 005 at the assessment counter.

About Assessing

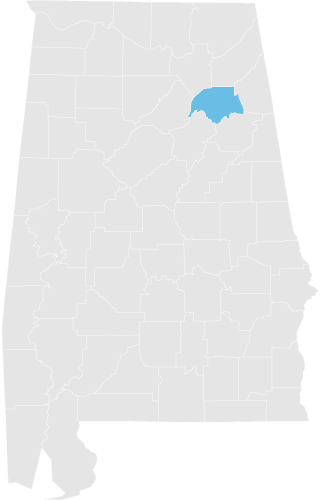

The Etowah County Assessing Department’s main focus is to help property owners receive all exemptions they may qualify for on their property, gather correct mailing addresses for tax notices, and help answer any questions they may have regarding property assessed in their name.

Address Change

Manufactured Home Law Fee

Information On OPPAL Optional Personal Property Assessment Link

Click here for OPPAL Information.

Collections

Please call our office for payment options at 256-549-5328

*** IMPORTANT INFORMATION FOR TAX PAYERS ***

2024 VALUE NOTICES

2024 Insolvent Taxes

All Property (Ad Valorem) taxes are taxes due on real and/or business personal property. Taxes are due each year on October 1st and are delinquent on January 1st. Tax notices are mailed out in October of each year as a courtesy. Payments may be made online or the Etowah County Courthouse, Rm 005.

Contact Us at (256) 549-5328

GovEase: (769) 208-5050 ext 2

Deliquent Parcel Search: https://etowahproperty.assurancegov.com/Property/DelinquentParcels

Etowah County Tax Lien Auction set for May 1, 2025 at 8:30 am

The Etowah County Tax Lien Auction will be held at govease.com Registration: April 1, 2025 First Rights Claims: April 1-24, 2025 Pre Bidding: April 30, 2025 8:30 am Tax Lien Auction: May 1, 2025 8:30 am Contact Us at (256) 549-5328 GovEase: (769) 208-5050 ext 2 Deliquent Parcel Search: https://etowahproperty.assurancegov.com/Property/DelinquentParcels

Manufactured Home Decal Renewals

Manufactured home decals are due October 1st of each year. You have until the end of November to renew. You may pay online at: renewyourtag.com You may mail your payment to : 800 Forrest Avenue, Room 5, Gadsden, Alabama 35901 If you have any questions please call: 256-549-5328 or 256-439-6002 Payments made after November 30th of each year will have a late fee assessed to them. The late fee is $10.00. Failure to pay the registration fee and properly displaying the Mobile Home decal by December 1st of each year, also subjects the owner to a citation fee of $15.00. After 15 days (from the date of the citation), if the bill is still not paid, a penalty of $24.00 will be assessed against the owner. All fees and penalties are due before a decal may be issued. Decals must be displayed on the mobile home as instructed or a citation may be issued